Plotting Real-time Data of Financial Performance with NVD3

PubNub

JANUARY 8, 2025

How to collect and plot real-time financial data based on performance using NVD3, PubNub, and AngularJS.

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Financial Related Topics

Financial Related Topics

PubNub

JANUARY 8, 2025

How to collect and plot real-time financial data based on performance using NVD3, PubNub, and AngularJS.

TDAN

NOVEMBER 20, 2024

Data quality issues continue to plague financial services organizations, resulting in costly fines, operational inefficiencies, and damage to reputations. Key Examples of Data Quality Failures — […]

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Cisco Wireless

NOVEMBER 25, 2024

Learn how financial institutions can address ransomware and software and patch requirements to address public vulnerabilities.

Cloudera Blog

FEBRUARY 15, 2024

It’s hard to believe it’s been 15 years since the global financial crisis of 2007/2008. There will inevitably be another global financial crisis, but robust data capabilities allow institutions globally to better adapt to regulations, implement compliance strategies, and predict risk.

InfoQ Articles

NOVEMBER 19, 2021

Financial services especially stand to benefit from the trend of adopting low code/no code to drive digital transformation. Low code/no code can help firms achieve the four key performance metrics described in the State of DevOps Reports and Accelerate, to achieve a faster pace of software development. By Tracy Miranda.

Cisco Wireless

NOVEMBER 25, 2024

Learn how financial institutions can address ransomware and software and patch requirements to address public vulnerabilities.

Cloudera Blog

MAY 30, 2024

The financial services industry is undergoing a significant transformation, driven by the need for data-driven insights, digital transformation, and compliance with evolving regulations. TAI Solutions provides IT services and solutions to major players in the financial services industry, particularly in the banking and insurance sectors.

Confluent

NOVEMBER 7, 2023

Use Confluent’s data streaming platform at the edge for quick and secure data exchange within and across financial institutions.

databricks

APRIL 3, 2024

In the era of rapid data growth and increasing pressure on financial institutions to utilize data for AI or genAI models, data governance.

databricks

MAY 2, 2023

Many financial institutions are developing a multi-cloud strategy to reduce operational risk, adhere to regulatory requirements, and also to benefit from a choice.

Confluent

MAY 17, 2024

Powering 48% of Nigeria's GDP through financial tools, Moniepoint overcame its scaling hurdles with Confluent, from eliminating replication lags to revolutionizing microservices.

ByteByteGo

DECEMBER 12, 2024

They power everything from e-commerce platforms and financial systems to social media and analytics tools. Databases are the backbone of modern applications. Ensuring good database performance is critical, as it directly impacts user experience, operational costs, and the ability to scale when needed.

databricks

OCTOBER 1, 2024

Introduction Retrieval-augmented generation (RAG) has revolutionized how enterprises harness their unstructured knowledge base using Large Language Models (LLMs), and its potential has far-reaching.

Confluent

NOVEMBER 3, 2023

With 5 million Kafka engineering hours invested and a 99.99% SLA, Confluent’s data streaming platform is helping new and existing financial services firms bring great experiences to customers.

databricks

JANUARY 31, 2023

Introduction Financial services institutions (FSIs) around the world are facing unprecedented challenges ranging from market volatility and political uncertainty to changing legislation and.

Confluent

SEPTEMBER 12, 2022

How banks and finance companies use Confluent to transform their digital systems with event-driven architecture, real-time payment processing, fraud detection, and analytics.

Dataversity

NOVEMBER 29, 2024

Despite various reasons for […] The post A Financial Approach to Evaluating Data, Analytics, and AI Investments appeared first on DATAVERSITY. In 2019, VentureBeat reported that 87% of data and analytics (D&A) projects failed to reach production.

InfoQ Articles

MAY 21, 2021

Microservices are the hot new architectural pattern, but the problem with “hot” and “new” is that it can take years for the real costs of an architectural pattern to be revealed. Fortunately, the pattern isn’t new, just the name is. So, we can learn from companies that have been doing this for a decade or more. By Jonathan Allen.

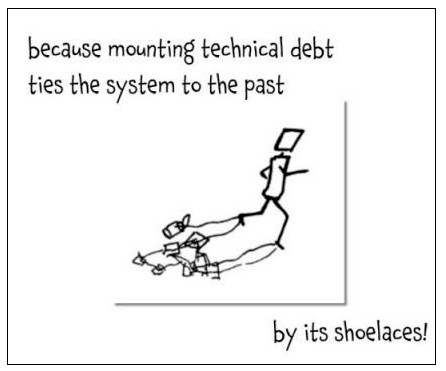

Mathias Verraes

JANUARY 8, 2025

It shares many analogous properties with financial debt: loans, accrued interest, token payments, bankrupty There is a key difference however. We take financial debt with another party. If you ask your CFO how much financial debt your organisation has, shell show you spreadsheets, graphs, payment plans, and projections.

Confluent

JUNE 21, 2023

See why Wealthsimple chose Confluent to build real-time API financial solutions that could process, transform, and govern real-time data for downstream systems.

Dataversity

AUGUST 19, 2024

While many companies focus on reducing expenses related to infrastructure – such as virtual machines and serverless architectures – data management costs frequently go unchecked until […] The post Cutting Hidden Costs: Optimizing Data Management for Financial Efficiency appeared first on DATAVERSITY.

Confluent

SEPTEMBER 15, 2023

Data streaming breaks down silos and fosters innovation across financial services, including risk, capital markets, consumer banking, payments, insurance, and more.

databricks

DECEMBER 18, 2024

Czech savings bank esk spoitelna , a division of Austrias Erste Group , recently collaborated with AI solution builder DataSentics to explore the.

Confluent

AUGUST 9, 2023

Our Financial Services Competency from AWS highlights Confluent's Includes specialized workloads related to the financial services industry specialization held by Confluent.

Khan Academy

JANUARY 2, 2025

This year, its time to make a resolution that will truly set you up for success: financial empowerment. Why financial resolutions are a game-changer Financial resolutions arent just about dollars and cents. Why financial resolutions are a game-changer Financial resolutions arent just about dollars and cents.

databricks

JULY 1, 2024

Discover how Databricks unlocks the transformative power of enterprise AI, from fraud detection to financial forecasting, and learn to harness AI's potential in your business.

databricks

MARCH 4, 2024

Special thanks to Barb MacLean, SVP, Head of Technology Operations and Implementation at Coastal Community Bank (Coastal) and Rob Cavallo, President at Cavallo.

Cockroach Labs

NOVEMBER 19, 2024

The financial services industry operates in a high-stakes environment where the need for reliability, scalability, and security is paramount. In this article we explore how the combination of CockroachDB and Microsoft Azure provides financial institutions with the tools they need to scale securely and efficiently.

Dataversity

SEPTEMBER 13, 2023

Cloud economics, in particular, is a framework that has been tailored to evaluate and enhance the financial dimensions of harnessing […] The post How Cloud Economics Help Businesses Build Cyber Resilience in the Cloud appeared first on DATAVERSITY.

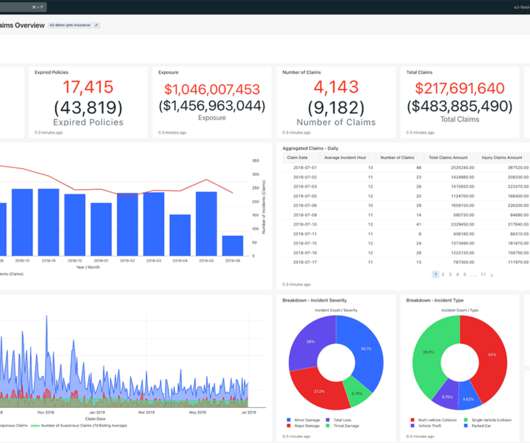

Vertiv

JANUARY 8, 2025

Customer demand remains strong with orders up 13% and backlog at record high $1.6B. COVID-19 impact and overall first quarter results in-line with our internal expectations. Quickly implemented $60 million of mitigating cost actions to be.

databricks

APRIL 21, 2023

Register now for the virtual replay Imagine a retail bank funding home loans in minutes. Or an insurer underwriting with 200 billion parameters.

TDAN

SEPTEMBER 1, 2020

Voice, messaging and artificial intelligence are helping transform customer engagement, particularly in financial services. Tech companies and financial institutions are working carefully to implement artificial intelligence and interactive voice banking technologies to change both the personal involvement and […].

Mathias Verraes

JANUARY 8, 2025

But, like financial debt, technical debt is not always a bad thing. In any company, the CFO knows exactly how much financial debt there is. And its not only code: Artifacts like architecture, documentation, tests, and domain models can all suffer from technical debt. Technical debt can severely drag down development.

databricks

JULY 29, 2024

Financial Valuations & Comparative Analysis Financial institutions specialized in capital markets such as hedge funds, market makers and pension funds have long been.

InfoQ Articles

JANUARY 27, 2022

Companies need teams working on infrastructure, tooling and platforms; the way they work has to change so that they do not become a bottleneck. These teams need to be about enabling product teams to deliver business value.

InfoQ Articles

JUNE 5, 2024

A single line of code can shape an organization's financial future. Erik Peterson, the CTO and founder at CloudZero, presented an engineering perspective on cloud cost optimization at QCon San Francisco. By Erik Peterson

InfoQ Articles

DECEMBER 25, 2020

In this article, author discusses the importance of using synthetic data in data analytics projects especially in financial institutions to solve the problems of data scarcity and more importantly data privacy. By Dawn Li.

Dataversity

OCTOBER 27, 2023

Customer data, financial records, and intellectual property are susceptible to cyber threats. In today’s digital world, data rules. Yet information must remain confidential to have any value in a business context. As a result, reinforcing security is a must for organizations that want to keep their reputation.

Confluent

NOVEMBER 27, 2023

See how a derivatives clearing organization unlocks real-time risk management to operate efficiently, at scale.

Cloudera Blog

JUNE 12, 2024

In Financial Services, the projected numbers are staggering. While these numbers reflect the potential impact of broad implementation, I’m often asked by our Financial Services customers for suggestions as to which use cases to prioritize as they plan Generative AI (GenAI) projects, and AI more broadly.

ByteByteGo

JANUARY 14, 2025

Financial Impact: These performance improvements translated into an incremental gross booking increase estimated in the hundreds of millions of dollars annually. At Uber’s scale, even small percentage gains in conversion or recovery rates generate significant financial returns.

Confluent

APRIL 28, 2020

Mainframes are still ubiquitous, used for almost every financial transaction around the world—credit card transactions, billing, payroll, etc. You might think that working on mainframe software would be dull, requiring […].

databricks

JUNE 28, 2024

Introduction Financial institutions face a demanding environment with complex regulatory examinations and a pressing need for flexible and comprehensive risk management solutions.

Mathias Verraes

JANUARY 8, 2025

Reports in financial statements dont just cover any random period, they cover months, quarters, or years. php $reportingPeriod = ReportingPeriod :: forDuration ( DateTime $startDate , $days ); Applying Domain-Driven Design Now lets take a closer look at the domain. (Of Lets make that explicit: <?php

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content